Tips For The Rookie Investor From ‘The Richest Man In Babylon’

Secrets from the timeless finance book, 'The Richest Man In Babylon' on Investing

Some 9,000 years ago, there lived a man named Bansir who lived a very simple life. His job was to make chariots for the rich and was indeed one of the finest chariot makers in the city. Despite that, he was worried about his financial situation as he seemed to always be broke.

Bansir was sitting in front of his house, one day, daydreaming about how wealthy he was going to be when his friend Kobbi walked up to him and asked him for a loan.

Bansir explained that he didn’t have money. “Even though I have worked hard all my life, I still have no money to take care of myself properly, not to talk of giving any.”

As he spoke, Kobbi had an idea. “Why don’t we visit Arkad, the actual richest man in town and ask him for some tips on how he made his money. Bansir thought it was a great idea since they had grown up together.

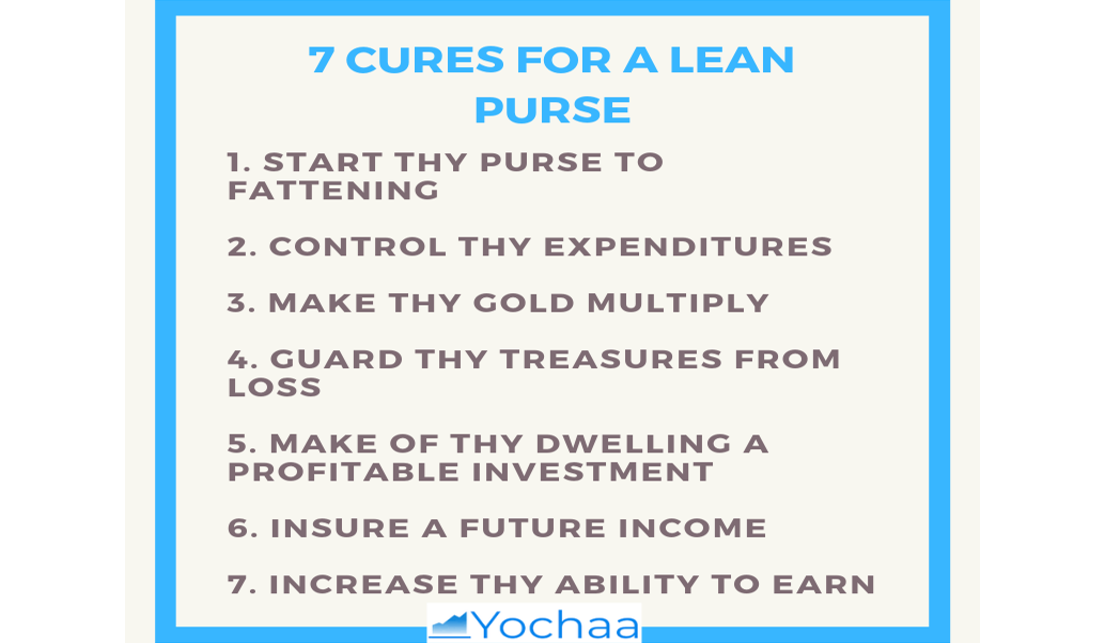

When they met Arkad, they quickly explained their challenge and Arkad gave them some guidlines he titled, “7 cures for a lean purse.” He explained that he too had made many investment mistakes and proceeded to tell them his story.

He had worked for a rich man named Algamish who promised to teach him how to be wealthy in exchange for some free work. His lessons were captured in a list known as, “7 cures for a lean purse” and Arkad began from step 1 by increasing his sources of income, watching his expenses, and saving.

.

Arkad was advised to save a minimum of 10% of his income and he did so diligently. Following Algamish’s advise on investing, he had also invested his money into something that brought him passive income. However, when he got the returns on his investment, he spent them on wine and a fine tunic.

Algamish who was baffled, asked him “how do you suppose your money and the moneys children will work for you when you spend it on luxuries.” He told Arkad that he was never going to become rich if he continued living that way.

So, Arkad made changes. After saving 10% of his income for a full year, he met a bricklayer who pitched an investment idea to him about buying some Jewelry from a far away land. It was an amazing opportunity and Arkad was glad he had the funds to do it.

When Algamish came back to ask what he had done with the savings this time, Arkad proudly explained that he had given it to a bricklayer to help him invest in Jewelry. Algamish was angry! “What does a bricklayer know about Jewelry?!”

Algamish immediately told him that he had lost his money by investing in something that sounds too good to be true and had to begin even again. Arkad learnt every step of the way until he became the richest man in Babylon.

‘The Richest Man In Babylon’ by George S. Clason, is one of the greatest personal finance books of all time as it holds timeless secrets to wealth creation. While further finance theories have been changed over time, the principles still hold.

Bansir in today’s world represents the average 9-5 worker, who lives from paycheck to paycheck – efforts never really matching results. The gap from being constantly broke to being in control of your finances is being able to make good investment decisions.

In order to avoid the rookie mistake Arkad made, here are some investing tips he learnt on his journey.

Invest in Things You Are Knowledgeable About

When an investment opportunity looks too good to be true, it probably is and the only way to know for a fact whether you are making a good investment decision or not is to have the right information about it.

The only way to move from the unknown to the known is to learn about it and this is what the Yochaa insight page is all about. Many have lost significant amounts of money my following the crowd; do not be one of them.

Invest The Principal and the Interest to Unleash The Compound Effect

There was nothing wrong with what Arkad did when he squandered the gains on his investment. The challenge is that at the end of the day, it is almost as if there was no investment made at all.

Investing both the principal and the interest or dividend received in the case of stocks, allows you unleash the compounding effect of your investment which can be exponential.

Guard Your Treasures

If you have read the book, then you would know that Arkad next set of investments were careful. Not only did he invest in things he knew, but he also followed up.

Guarding your treasures in today’s world involves watching the trends of your investment and this is what the portfolio page on the app is all about. If you don’t guard it, you would lose it.

Don’t Take Too Much Risk

One of the things Arkad also shared with his poor friends was that they should invest in assets that ensured their principal were safe.

However, investments that guarantee your principal, like Treasury Bills, often have low yields. Now, this does not mean you would gamble your life savings. What you should do is balance your risk and your reward; a great way to do this is to diversify.

Seek Advice From Experts

A bricklayer really has no business investing in Jewelry! Seeking advice is great but it is important that you take advise from experts. The fact that your sister made money investing in Cryptocurrency doesn’t make her a thought-leader on the matter.

Investment is no small task and this is why we have trusted market analysts who offer well-researched investment recommendations.

The great news is that if you’re right here, you are already on a guided journey to wealth creation and you just might be the one to snatch the 'richest man' seat away from Dangote.

[Written by Lawretta Egba]