How To Start Investing With Little Money

Many people erroneously believe that they need huge sums of money to invest. Here are few ways to invest small suns of money

If you are reading this message, then you have more than enough money to invest with.

Millennials are probably some of the most interesting set of people ever. I would know, because I’m a millennial myself. They are daring, willing to take the biggest risks, are hungry to succeed, and like to approach life on their own terms.

Thanks to the advancement of their time, they are also largely privileged. As such, the average millennial has a nice smartphone, and at least a pair of designer sunglasses, a designer bag or a designer shoe. Yet, if you ask them about investment, they would conveniently explain to you how they cannot afford it yet.

The irony of the millennial lifestyle is not common to millennials alone. Many people erroneously believe that they need to have saved bucket loads of cash before they can invest funds or build wealth. So much so, that this ranks high as one of the primary reasons people don’t invest – they seem to never have enough to start.

Just like the financial experts will tell you that if you don’t save when you earn little income, you would also not be able to save when you have more; you would not be able to invest when the big funds come if you don’t make it a habit out of your little.

Rather than prioritizing liabilities like latest phones and sneakers, here are just three (3) of the cool ways you could invest your funds today for the betterment of your future – whether you have *arrived* or not.

Risk-Free Investment Options

One of the most convenient ways to invest is to put your money in risk-free investment vehicles. Not only do they offer you peace of mind as you put your finds aside, they also offer you the opportunity to build up finances in order to invest in more capital-intensive investment vehicles.

A great example of this is treasury bill. Treasury bills are secured investments to the government of a country. As such, they are as safe as the very existence of your country and they guarantee you a fixed interest rate together with your safe principal.

Another option is to take advantage of some of the unique savings account your bank offers to earn interest on your money for a short period of time.

Investment In Stocks

Investing in stocks allows you to own shares in public companies of your choice. As the value of the company grows, so does the value of your investment. The great part about investing in stocks is that there is no fixed amount required!

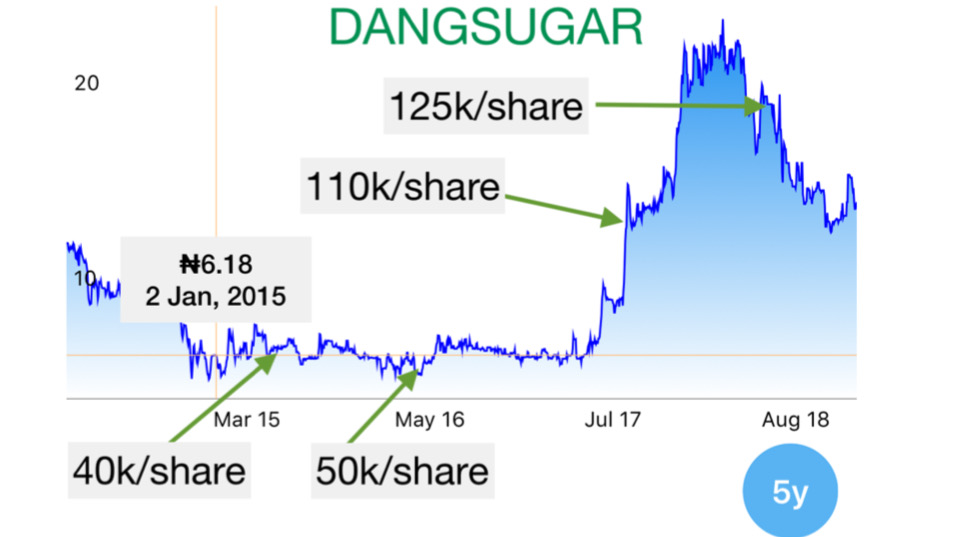

You simply set your budget and consult your stock broker. When investing in stocks, it is important to know which companies you want to invest in and that is usually based on the historical trend of the company as well as the available market information.

Don’t let all of these dissuade you though; it is easier than it sounds. On the Yochaa App, you get daily updates of the prices of company stocks, the rate of dividends they have paid over time, market information so you make insightful decisions, and even get to see exactly how much your investment has risen or fallen to on the portfolio page.

Leverage Mutual Funds

A mutual fund is an investment vehicle that is made up of a pool of funds obtained from multiple investors for the purpose of making investments. It’s slightly the same as when you and your friends come together to rent a house in order to split the cost requirement and also enjoy the benefits.

What a mutual fund does for you is give you the opportunity to invest in huge or capital-intensive projects that you would not be ordinarily able to afford. Mutual fund managers simply source funds in bits from investors and help them invest wisely.

They would usually spread the investment over a portfolio of assets as well as varying securities in order to provide for risk and hedge the possible impact of losses. While some mutual funds require a minimum sum, there are many mutual funds available in Nigeria that would not require you to have so much.

With these few points, I hope I have been able to convince you and not confuse you that it is actually possible to invest your next shopping allowance.

[Article by Lawretta Egba]